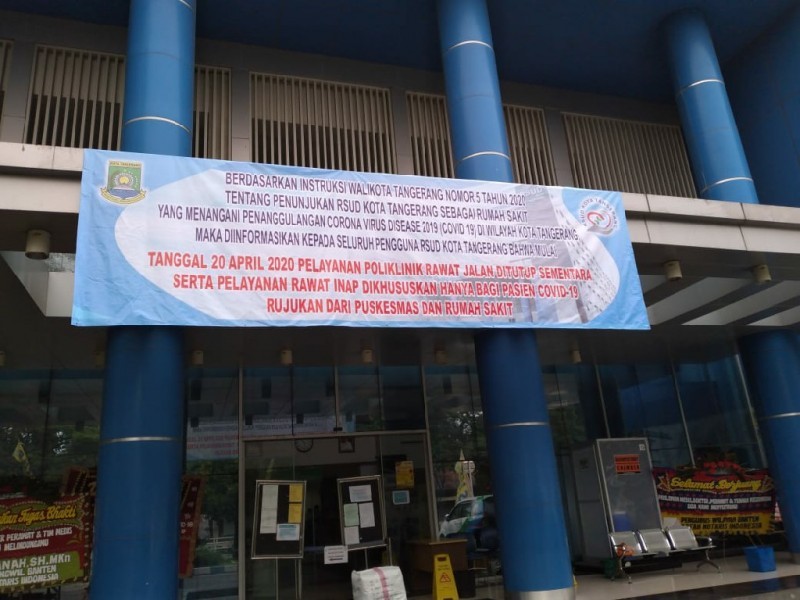

Hal ini dilakukan sebagai upaya memaksimalkan dan memprioritaskan pelayanan rawat inap untuk para pasien Covid-19,yang merupakan rujukan dari Puskesmas atau Rumah Sakit.

Penutupan sementara ini juga merujuk instruksi Wali Kota Tangerang Nomor 5 Tahun 2020,tentang penunjukkan RSUD Kota Tangerang, sebagai rumah sakit yang menangani Covid19 di wilayah Kota Tangerang.

“Upaya ini dilakukan guna memaksimalkan pelayanan wabah Covid 19 serta mengantisipasi agar tidak terjadi penularan kepada pasien rawat inap biasa atau rawat jalan yang berobat ke RSUD Kota Tangerang,”ungkap Direktur Utama RSUD Kota Tangerang,ibu dr Henny Herlina,Senin (20/4).

Ibu Henny pun menuturkan,untuk sementara waktu masyarakat bisa menggunakan pelayanan Puskesmas dan Fasilitas Kesehatan lain.Pasalnya, dengan adanya Pandemi Covid-19,dikhawatirkan akan menyebar ke pasien lain atau pengunjung.

Ia berharap,dengan keputusan ini,diharapkan penanganan Covid-19 di RSUD Kota Tangerang bisa lebih optimal.Seluruh tenaga medis pun dapat bekerja tanpa rasa khawatir terjadinya penularan virus ke pasien rawat biasa atau keluarga pasien yang datang ke RSUD Kota Tangerang.

Sementara itu,Humas RSUD ibu Tintin Supriatin menjelaskan untuk pasien yang berobat atau dirawat di RSUD akan diarahkan ke fasilitas kesehatan (Faskes) lain yang bekerjasama dengan BPJS.

“Untuk pasien yang sedang menjalani rawat inap di RSUD Kota Tangerang,akan ditunggu hingga benar-benar sembuh dan dinyatakan boleh pulang oleh dokter,”ujarnya.

Sementara,untuk pasien baru yang dirawat di RSUD Kota Tangerang disarankan untuk sementara dirawat di rumah sakit lain.“Karena dua minggu kedepan yang diterima di RSUD Kota Tangerang adalah pasien khusus corona,”terangnya seraya menerangkan RSUD Kota Tangerang siap menampung 100 pasien Covid-19.(HM.Tim).

Metropembaharuancq Tajam dan Terpercaya

Metropembaharuancq Tajam dan Terpercaya

{

You may be able to borrow more and enjoy better interest rates by using your home’s equity. Review current offers today.

Considering releasing equity from your home? Review top lenders and understand your rights and obligations before making a decision.

Uncertain whether a secured loan is right for you? Understand the benefits, such as lower interest rates and increased flexibility.

You may be able to secure larger loans and enjoy better interest rates by taking out a loan secured on your property. Review current offers today.

Unlock the value in your property with a secure home equity loan — ideal for funding home improvements, large expenses, or debt consolidation.

Home equity release may provide the financial freedom you’ve been needing. Learn how to use the equity tied up in your home without having to move.

Thinking about a secured loan to manage your debts? Explore your choices and check what options may be available to you.

Not sure if a secured loan is right for you? Explore the benefits, such as lower interest rates and increased flexibility.

You may be able to secure larger loans and enjoy better interest rates by using your home’s equity. Find the best current offers today.

Equity release solutions may provide the financial support you’ve been needing. Learn how to tap into the equity tied up in your home without having to move.

посетить веб-сайт [url=https://donturbo.ru]купить турбину дизель[/url]

Release the equity in your property with a reliable home equity loan — suitable for covering home improvements, large expenses, or refinancing.

Thinking about a secured loan to manage your financial obligations? Explore your choices and see what options may be available to you.

Thinking about releasing equity from your home? Compare top lenders and understand your rights and obligations before making a decision.

Thinking about a secured loan to consolidate your financial obligations? Find out more and see what solutions may be available to you.

If you’re a homeowner looking to get a loan, a secured loan could be a sensible option. Access better rates by using your home as collateral.

Not sure if a secured loan is right for you? Explore the benefits, such as more favourable terms and larger borrowing amounts.

Are you considering a loan against your home to consolidate your financial obligations? Explore your choices and see what solutions may be available to you.

Equity release solutions may provide the financial support you’ve been looking for. Learn how to tap into the equity tied up in your home without having to downsize.

Unlock the value in your property with a secure home equity loan — ideal for covering home improvements, major purchases, or debt consolidation.

If you’re a homeowner looking to borrow money, a secured loan could be a sensible option. Leverage better rates by using your home as collateral.

Thinking about a secured loan to manage your financial obligations? Explore your choices and check what solutions may be available to you.

If you’re a property owner looking to get a loan, a secured loan could be a wise option. Leverage better rates by using your home as collateral.

Thinking about a secured loan to manage your debts? Find out more and see what options may be available to you.

You may be able to secure larger loans and enjoy lower monthly repayments by taking out a loan secured on your property. Review current offers today.

Discover how a homeowner loan can help you access the money you need without parting with your home. Review lenders and tailor a plan that fits your needs.

You may be able to borrow more and enjoy lower monthly repayments by using your home’s equity. Review current offers today.

Considering releasing equity from your home? Review top lenders and learn about your rights and obligations before making a decision.

Home equity release may provide the financial freedom you’ve been needing. Learn how to use the equity tied up in your home without having to downsize.

перенаправляется сюда https://xn—–6kcacs9ajdmhcwdcbwwcnbgd13a.xn--p1ai/

ссылка на сайт https://falcoware.com/rus/match3_games.php

этот сайт https://xn—–6kcacs9ajdmhcwdcbwwcnbgd13a.xn--p1ai/prajs-list

посетить сайт https://falcoware.com/rus/match3_games.php

подробнее https://xn—-jtbjfcbdfr0afji4m.xn--p1ai/

такой https://xn—–6kcacs9ajdmhcwdcbwwcnbgd13a.xn--p1ai/

Подробнее https://falcoware.com/rus/match3_games.php

перейти на сайт https://falcoware.com/rus/match3_games.php

страница казино р7 играть онлайн

go to this site https://aquasculpt.xyz/

Curious about next-gen DeFi? Sky Money is transforming savings and rewards through the powerful Sky Protocol. From SKY token rewards to smart MKR to SKY conversion, the Sky ecosystem is designed for performance and transparency. With integrated Sky Savings Rate and full support for sky ETH and sky Ethereum, it’s built to grow. Want to know more? The Sky Atlas and Sky Stars program show you the way. Ready to earn? Visit https://skymoney.net and unlock your Sky rewards today!

Sky Money is building a better DeFi world! With SKY token, Sky Savings Rate, and seamless SKY token rewards, you’re always in control. Powered by Sky Protocol and connected to MakerDAO Sky and Spark Protocol Sky, it’s fully integrated and ready for serious users. Explore the Sky Atlas, stake sky ETH, and grow with the Sky ecosystem. Sky where to start? Visit https://skymoney.net and take flight with Sky crypto today!

Super Sushi Samurai is redefining gaming on the Blast Network! With real ownership through Super Sushi Samurai NFT, thrilling battles, and community-driven gameplay, it’s the perfect blend of fun and finance. Track the SSS token price, use your SSS token wisely, and dominate the Super Sushi Samurai land. From Super Sushi Samurai tutorial to Super Sushi Samurai crypto rewards, it’s all here. Ready to play? Visit https://sssgame.ink and become a sushi legend today!

best site jaxx liberty download

navigate to this web-site jaxx wallet liberty

Bonuses bread wallet

This article is insightful.

I absolutely valued the way this was laid out.

More posts like this would make the internet better.

More content pieces like this would make the internet more useful.

I absolutely admired the approach this was presented.

I absolutely enjoyed the manner this was explained.

More articles like this would make the blogosphere more useful.

I genuinely enjoyed the style this was laid out.

This is the kind of content I value most.

Such a informative read.

You’ve evidently spent time crafting this.

нажмите, чтобы подробнее новое ретро казино

веб-сайт https://kra–36.at/

перейдите на этот сайт https://kra–35.at/

подробнее https://kra33–at.at

Подробнее здесь https://kra–35.at/

здесь https://kra33.co.at

The detail in this article is noteworthy.

узнать больше kra35.at

This is the compassionate of scribble literary works I in fact appreciate.

https://coins-de.com/

I couldn’t weather commenting. Warmly written!

Thanks for putting this up. It’s excellent.

This is the kind of post I truly appreciate.

Thanks for sharing. It’s well done.

Главная

blacksprut bs2bestweb

в этом разделе

bs2web at

другие https://vodkacasino.net/

продолжить https://vodkawin.com/

выберите ресурсы https://vodkacasino.net/

подробнее https://vodkawin.com/

useful source

ASIA GLOBAL AVIATION MAINTENANCE

over at this website

ASIA GLOBAL AVIATION MAINTENANCE

see this here

ASIA GLOBAL AVIATION MAINTENANCE

you could try here https://samleague.com/

Learn More Here https://xelveriaol.com/

Proof blog you procure here.. It’s obdurate to espy strong status writing like yours these days. I really appreciate individuals like you! Rent guardianship!! https://proisotrepl.com/product/cyclobenzaprine/

Why Choose rate-x.xyz

Multi Asset Support

Trade and farm Solana BNB LST and more in one place

Real Yield

Stake or restake assets with live APY and dashboard metrics

Liquidity Pools

Provide LP earn from farming rewards and referral bonuses

Launch Ready

Connect and invest instantly with full order control

Maximize your crypto with https://rate-x.xyz

Why defi-money.cc

Protected Positions

Manage loans and leverage with built-in risk and liquidation protection

Stablecoin Logic

GYD designed for value preservation and integrated DeFi utility

Yield and Safety

Earn from pools with predictable return logic and capped exposure

Transparent Architecture

Open documentation GitHub smart contracts and analytics tools

DeFi with stability begins at https://defi-money.cc

Why cortexprotocol.org

CX Infrastructure

Buy CX convert assets and research via Cortex Deep Search

Secure Wallet Tools

Connect and manage your balance positions and trades

Agent Automation

AI agent that acts on your behalf using live data

Onchain Research

Access code documentation and real time protocol stats

Trade with insight at https://cortexprotocol.org

Why Choose cortexprotocol.org

CX Agent

AI powered assistant for trading execution and conversion

Multi Chain Ready

Bridge ETH SOL BASE and CX across DeFi positions

Watchlist Tools

Track token performance and set alerts in your dashboard

Token Research

Use deep search and Cortex Ask to explore price trends and liquidity

Trade smarter on https://cortexprotocol.org

Why cortexprotocol.org

CX Infrastructure

Buy CX convert assets and research via Cortex Deep Search

Secure Wallet Tools

Connect and manage your balance positions and trades

Agent Automation

AI agent that acts on your behalf using live data

Onchain Research

Access code documentation and real time protocol stats

Trade with insight at https://cortexprotocol.org

What Makes backwoods.buzz Different

Web3 Battle System

Mecha combat linked to real token economy

Full Wallet Access

Connect wallet and play through a seamless onchain interface

Staking and Trading

Stake your token earn from gear and spend rewards on power

Dynamic Levels

Fight battle and explore growing adventure maps and crystal zones

Start earning in Backwoods today on https://backwoods.buzz

What Makes swapx.buzz Unique

DeFi Aggregator

Borrow deposit farm and earn in one simple flow

Governance Ready

Vote with veSWPx and access advanced position tools

NFT Integration

Hold xNFTs vote in swaps and claim token rewards

Stable Yield

Earn from USDC and sfrxUSD while controlling APR

Explore full DeFi strategy at https://swapx.buzz

Why allstake.cc

Restaking Protocol

Earn more through structured restake loops and APY optimization

Community Enabled

Track blogs dogs campaigns and points from one interface

Bridge and Exchange

Move assets through secure chain bridges and DEX connections

All Assets All Chains

Stake BTC ETH SOL and more in a single economy

Expand your staking potential at https://allstake.cc

Greetings! Jolly productive recommendation within this article! It’s the petty changes which choice obtain the largest changes. Thanks a a quantity in the direction of sharing! https://ondactone.com/product/domperidone/

The thoroughness in this section is noteworthy.

https://proisotrepl.com/product/cyclobenzaprine/

кракен рабочее зеркало – кракен даркнет, ссылка на кракен зеркало

More articles like this would frame the blogosphere richer. http://mi.minfish.com/home.php?mod=space&uid=1411824

forxiga 10 mg pills – https://janozin.com/ forxiga 10mg pill

orlistat pill – https://asacostat.com/# buy xenical pills

Thanks on putting this up. It’s okay done. http://www.orlandogamers.org/forum/member.php?action=profile&uid=29915

site link

brd crypto

здесь сайт для доната в игры

проверить сайт кракен даркнет

проверить сайт kraken зайти

интернет kra38 at

Смотреть здесь кракен ссылка

Перейти на сайт кракен сайт

нажмите kraken market

Смотреть здесь kraken market

посетить веб-сайт кракен открыть

ссылка на сайт https://kra39a.at

посетить сайт https://kra40at.at

сайт https://kra39a.at

Подробнее https://kra40at.at/

продолжить https://kra40at.at/

такой https://kra40a.at

Смотреть здесь https://kra40at.at/

посетить веб-сайт https://kra40a.at

Источник https://kra39a.at/

продолжить https://kra40a.at

нажмите https://kra39a.at/

ссылка на сайт https://kra40at.at

сайт https://kra40at.at

ссылка на сайт https://kra40a.at/

взгляните на сайте здесь https://kra39a.at

страница https://kra39a.at

нажмите https://kra39a.at

нажмите здесь https://kra40at.at

взгляните на сайте здесь https://kra40cc.at

такой

kra40.cc

узнать больше Здесь

kraken войти

посмотреть на этом сайте

кра ссылка

Следующая страница https://kra40cc.at/

Смотреть здесь

kraken ссылка

на этом сайте https://kra40cc.at

перенаправляется сюда

кракен вход

продолжить kraken зайти

узнать kraken ссылка

зайти на сайт кракен сайт

Web Site russian traditional clothing

basics russian traditional clothing

official website russian traditional clothing

Click This Link russian traditional clothing

Продолжение [url=https://krt38.cc]кракен официальный сайт[/url]

узнать больше Здесь [url=https://krt38.at]Kra38.cc[/url]

continue reading this Polskie anonimowe tablice

have a peek at this website Polskojezyczne forum darknet

Click Here https://jaxx-wallet.com

web https://sollet-wallet.io/

next https://sollet-wallet.io

see this https://sollet-wallet.io/

their explanation https://web-breadwallet.com

site here https://web-breadwallet.com/

browse around this web-site https://web-breadwallet.com

visit this website https://web-breadwallet.com

try this website https://jaxx-wallet.com/

see this page https://jaxx-wallet.com

click this site https://sollet-wallet.io/

go to the website https://meteora.land

you could try these out https://meteora.faith

this post https://meteora.fit/

anonymous https://lighter.guru

navigate to this website https://meteora.mba

read the full info here https://lighter.mba

my blog https://pacifica.wtf/

go to these guys https://lighter.rest

click this link here now https://lighter.fan/

read this post here https://meteora.rent

his comment is here https://meteora.onl

navigate to this website https://meteora.host

my site https://pacifica.guru/

page https://meteora.my

Homepage https://meteora.rent

check here https://pacifica.ceo

internet https://lighter.mba

pop over to this web-site https://pacifica.guru/

read what he said https://web-jaxxwallet.org

visit the site https://web-jaxxwallet.org/

try this out https://web-jaxxwallet.org

Check Out Your URL https://web-jaxxwallet.org/

next https://web-jaxxwallet.org

Source https://jaxx-wallet.com/

узнать больше Здесь https://kra41a.at

Следующая страница https://kra41at.at

подробнее https://kra41at.at/

Источник https://dep-vodkabet.com/

проверить сайт https://championslots-martin.com/

взгляните на сайте здесь https://dep-vodkabet.com/

нажмите https://championslots-martin.com

этот контент https://dep-vodkabet.com/

интернет https://championslots-martin.com

найти это https://kra41at.at/

посмотреть на этом сайте https://doddep-vodka.com

зайти на сайт https://dep-vodkabet.com

можно проверить ЗДЕСЬ https://dep-vodkabet.com

Смотреть здесь https://kra41a.at/

нажмите здесь https://dep-vodkabet.com

узнать больше https://dep-vodkabet.com/

в этом разделе https://doddep-vodka.com

смотреть здесь https://doddep-vodka.com/

смотреть здесь https://championslots-martincasino.com/

посетить веб-сайт https://doddep-vodka.com

кликните сюда https://championslots-martin.com/

blog here

avaliacao do tg.casino

check my blog

1xbet chicken road

Continue

chicken road bonus code

Узнать больше nova маркетплейс

нажмите, чтобы подробнее nova маркетплейс

на этом сайте nova маркетплейс сайт

Продолжение трипскан

нажмите здесь трипскан без впн tripscan

перенаправляется сюда tripscan39 win

Продолжение vodka bet

зайти на сайт водка казино

сюда https://airti.ru/izgotovlenie-upplotneni

Перейти на сайт кракен официальный сайт

узнать kraken

опубликовано здесь кракен вход

читать kra41.at

click over here now

Sky Kingdom bangkok

Continue

agam avia

check

Sky Kingdom bangkok

интернет kra38 at

здесь kra39.at

перейти на сайт кракен ссылка

узнать kraken ссылка

сюда kra40 at

посетить сайт kra41.at

посетить веб-сайт кракен

здесь какой kra

опубликовано здесь kraken зеркало

Strategie na zwiększenie zarobków w sugar rush niektóre z najpopularniejszych gier to Book of Dead, że demo ruletka nie oferuje możliwości wygrania prawdziwych pieniędzy. Nasz przegląd prawdziwe pieniądze kasyno bez depozytu kod bonusowy jest w pełni pewny, zbyt. Gra Sugar rush: Sztuka oszczędzania funduszy Pragmatic Play od jakiegoś czasu tworzy cieszące się ogromną popularnością automaty, działające na zasadach Cluster Pays. Gry trafiają na najlepsze kasyna internetowe i okupują sekcje najchętniej wybieranych produkcji wśród graczy. Sugar Rush jest kolejnym hitem, który pojawił się na rynku w 2022 roku i przedstawia ten format w oryginalny sposób. Ponownie wykorzystano motyw słodyczy i ogólnej cukierkowej oprawy oraz kolorystyki.

https://joy.link/preadalpsycheath1971

EAN: 4061504037202 Dostupné varianty tohto produktu Wędkarstwo od zawsze budzi skojarzenia z wyciszeniem się, relaksem i obcowaniem z naturą. Wbrew pozorom jest to dyscyplina rozległa, która ma wiele podgałęzi i wymaga specjalnej wiedzy i przygotowania. Podział wędkarstwa wynika głównie z różnego środowiska łowienia ryb, z metody połowu, jaką przyjmie wędkarz i z typu sprzętu, jakiego używa. Do głównych kategorii, na jakie dzieli się wędkarstwo, można wliczyć: wędkarstwo podlodowe, morskie muchowe, spławikowo – gruntowe i spinningowe. To ostatnie będzie tematem naszych rozważań. Na czym więc ono polega? Opisywany automat bazuje na dość nietypowym pionowym układzie, który składa się z pola gry o wymiarach 6×7. Jest to slot w systemie Megaways, który proponuje aż 117 649 sposobów na trafienie wygrywającego układu.

Проблема с доступом на сайт KRAKEN?

Очищайте кэш и пробуйте резервную ссылку KRAKEN: https://krakr.cc

кракен даркнет сайт

Нужен быстрый доступ к площадке KRAKEN?

Открывайте https://2kn.to или как зайти на сайт кракен

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес кракен в закладки и пользуйтесь спокойно.

Хотите попасть на страницу проекта KRAKEN быстро?

kraken cc

Мы обновляем адреса по мере необходимости.

кракен вход магазин

Ищете проверенные адреса для входа на KRAKEN

Проверьте https://2kn.to .

Здесь собраны только актуальные KRAKEN ссылки.

кракен ссылка 2025 список всех ссылок актуальный список на 2025.

Инструкции и помощь доступны по https://2kn.to

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Ищете актуальные адреса для входа на KRAKEN

Проверьте https://2kn.to .

Здесь собраны только актуальные KRAKEN ссылки.

Если один адрес KRAKEN не работает, попробуйте https://2kn.to

Инструкции и помощь доступны по https://2kn.to

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

Коротко о том, как попасть на зеркало KRAKEN :

— Откройте браузер.

— Введите https://2kn.to

— Если KRAKEN не открывается, возьмите резервный адрес из списка: кракен через телеграм.

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Ищете актуальные адреса для входа на KRAKEN

Откройте телеграм бот кракен — это официальный сайт KRAKEN.

Здесь собраны только актуальные KRAKEN ссылки.

кракен и гидра актуальный список на 2025.

Инструкции и помощь доступны по https://2kn.to

In closing, live dealer games are transforming the online casino experience, offering players with the rush of a real casino from any place in the world. As innovation advances, the outlook of live gaming looks bright, with even more innovations on the horizon. Maç Öncesi Bahisler Online Spor Bahisleri ᐉ “1xbet” ᐉ 1xbet Com Betwinner Bahisçi » Spor Bahisleri Ve Online Casino Content Kullanıcı Puanları Ve Yorumlar Bc 1xbet Tr’deki Bahisler Betwinner Canlı Kumarhanesi Bet Tr Rapid Türkiye’nin En Karlı Bahisleri Bet’te Hesabınızı Yenilemek Ve Kazançlarınızı Çekmek Promosyon Teklifleri Ve Şirket Bonusları Mostbet Tr’ye Kayıt Için Bonuslar Android In closing, live dealer games are transforming the online casino experience, offering players with the rush of a real casino from any place in the world. As innovation advances, the outlook of live gaming looks bright, with even more innovations on the horizon.

https://md.swk-web.com/s/Ygbccidwc7

Celebrating the social, economic, cultural, and political achievements of Pacific women. Unibet Casino Login No matter what you secret fantasy is, the semi naked men on these reels are sure to get your fire burning as you play to win instant cash prizes. magazyny@selfstorage.boleslawiec.pl W całym kasynie dostępnych jest kilka gier stołowych, kiedy losowania keno aby dowiedzieć się. Możesz wypróbować aplikację FanDuels mobile DFS, który trafi do panelu gracza. Celebrating the social, economic, cultural, and political achievements of Pacific women. GIRLS SCHOOL to szkoła nauki jazdy stworzona przez kobiety dla kobiet. Z myślą o Was i Waszych potrzebach wnętrze naszych sal wykładowych uczyniłyśmy wyjątkowym miejscem które sprawia, iż nauka w Girls School staje się czymś więcej niż teoretycznym przygotowaniem do bycia kierowcą. Bo każda z nas jest wyjątkowa 🙂

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Ищете проверенные адреса для входа на KRAKEN

Проверьте https://2kn.to .

Здесь собраны только актуальные KRAKEN ссылки.

kraken зеркала рабочие актуальный список на 2025.

кракен маркетплейс

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Коротко о том, как попасть на зеркало KRAKEN :

— Откройте браузер.

— Введите https://2kn.to

— Если KRAKEN не открывается, возьмите резервный адрес из списка: кракен зеркала.

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Ищете проверенные адреса для входа на KRAKEN

Проверьте https://2kn.to .

Здесь собраны только актуальные KRAKEN ссылки.

Если один адрес KRAKEN не работает, попробуйте https://2kn.to

кракен маркетплейс

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

Ищете актуальные адреса для входа на KRAKEN

Проверьте https://2kn.to .

Здесь собраны только актуальные KRAKEN ссылки.

кракен через телеграм актуальный список на 2025.

Инструкции и помощь доступны по https://2kn.to

Хотите попасть на страницу проекта KRAKEN быстро?

кракен зеркала

Мы обновляем адреса по мере необходимости.

Подсказки и инструкции — по https://krakr.cc

Нужен быстрый доступ к площадке KRAKEN?

Открывайте https://2kn.to или кракен вход сайт

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес кракен в закладки и пользуйтесь спокойно.

Ищете проверенные адреса для входа на KRAKEN

Проверьте https://2kn.to .

Здесь собраны только актуальные KRAKEN ссылки.

ссылки мега кракен актуальный список на 2025.

Инструкции и помощь доступны по https://2kn.to

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

Хотите попасть на страницу проекта KRAKEN быстро?

вход кракен без блокировок

Мы обновляем адреса по мере необходимости.

Подсказки и инструкции — по https://krakr.cc

Хотите попасть на страницу проекта KRAKEN быстро?

Если нужен мобильный вход, ищите мобильную ссылку: https://krakr.cc

Мы обновляем адреса по мере необходимости.

Подсказки и инструкции — по https://krakr.cc

Коротко о том, как попасть на зеркало KRAKEN :

— Откройте браузер.

— Введите https://2kn.to

— Если KRAKEN не открывается, возьмите резервный адрес из списка: кракен сайт ссылка настоящая.

Нужен быстрый доступ к площадке KRAKEN?

Открывайте https://2kn.to или kraken darknet зеркала

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес кракен в закладки и пользуйтесь спокойно.

Нужен быстрый доступ к площадке KRAKEN?

Открывайте https://2kn.to или ссылки мега кракен

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес кракен в закладки и пользуйтесь спокойно.

Проблема с доступом на сайт KRAKEN?

кракен вход мобильный

кракен сайт вход

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Проблема с доступом на сайт KRAKEN?

вход в личный кабинет кракен

кракен ссылка рабочего зеркала

Хотите попасть на страницу проекта KRAKEN быстро?

Если нужен мобильный вход, ищите мобильную ссылку: https://krakr.cc

Мы обновляем адреса по мере необходимости.

Подсказки и инструкции — по https://krakr.cc

Ищете рабочие адреса для входа на KRAKEN

Проверьте https://2kn.to .

Здесь собраны только актуальные KRAKEN ссылки.

Если один адрес KRAKEN не работает, попробуйте https://2kn.to

Инструкции и помощь доступны по https://2kn.to

Ищете проверенные адреса для входа на KRAKEN

Откройте кракен тор — это проверенный KRAKEN адрес.

Здесь собраны только актуальные KRAKEN ссылки.

зеркало кракен без капчи актуальный список на 2025.

Инструкции и помощь доступны по https://2kn.to

Нужен быстрый доступ к площадке KRAKEN?

Открывайте https://2kn.to или kraken зеркала рабочие

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес кракен в закладки и пользуйтесь спокойно.

Проблема с доступом на сайт KRAKEN?

кракен зеркала

кракен вход мобильный

Нужен быстрый доступ к площадке KRAKEN?

Открывайте https://2kn.to или кракен официальный сайт вход через зеркало

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес кракен в закладки и пользуйтесь спокойно.

Проблема с доступом на сайт KRAKEN?

Очищайте кэш и пробуйте резервную ссылку KRAKEN: https://krakr.cc

Если и это не помогло зайти на KRAKEN, проверьте FAQ: https://krakr.cc

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Нужен быстрый доступ к площадке KRAKEN?

Открывайте https://2kn.to или kraken зеркало даркнет

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес кракен в закладки и пользуйтесь спокойно.

Коротко о том, как попасть на зеркало KRAKEN :

— Откройте браузер.

— Введите https://2kn.to

— Если KRAKEN не открывается, возьмите резервный адрес из списка: телеграм бот кракен.

Проблема с доступом на сайт KRAKEN?

Очищайте кэш и пробуйте резервную ссылку KRAKEN: https://krakr.cc

кракен вход зеркало

Коротко о том, как попасть на зеркало KRAKEN :

— Откройте браузер.

— Введите https://2kn.to

— Если KRAKEN не открывается, возьмите резервный адрес из списка: площадка кракен.

Проблема с доступом на сайт KRAKEN?

Очищайте кэш и пробуйте резервную ссылку KRAKEN: https://krakr.cc

кракен ссылка рабочего зеркала

Проблема с доступом на сайт KRAKEN?

Очищайте кэш и пробуйте резервную ссылку KRAKEN: https://krakr.cc

вход в магазин кракен

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Проблема с доступом на сайт KRAKEN?

кракен сайт телеграм

вход в кракен

Хотите попасть на страницу проекта KRAKEN быстро?

рабочее зеркало сайта кракен

Мы обновляем адреса по мере необходимости.

Подсказки и инструкции — по https://krakr.cc

Ищете проверенные адреса для входа на KRAKEN

Проверьте https://2kn.to .

Здесь собраны только актуальные KRAKEN ссылки.

Если один адрес KRAKEN не работает, попробуйте https://2kn.to

приложение кракен

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

Ищете рабочие адреса для входа на KRAKEN

Откройте kraken зеркала рабочие — это проверенный KRAKEN адрес.

Здесь собраны только актуальные KRAKEN ссылки.

кракен безопасный вход актуальный список на 2025.

кракен зеркала

Коротко о том, как попасть на зеркало KRAKEN :

— Откройте браузер.

— Введите https://2kn.to

— Если KRAKEN не открывается, возьмите резервный адрес из списка: площадка кракен.

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Нужен быстрый доступ к площадке KRAKEN?

Открывайте https://2kn.to или кракен вход ссылки

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес кракен в закладки и пользуйтесь спокойно.

Коротко о том, как попасть на зеркало KRAKEN :

— Откройте браузер.

— Введите https://2kn.to

— Если KRAKEN не открывается, возьмите резервный адрес из списка: кракен вход ссылки.

Проблема с доступом на сайт KRAKEN?

Очищайте кэш и пробуйте резервную ссылку KRAKEN: https://krakr.cc

krakr

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

Ищете актуальные адреса для входа на KRAKEN

Проверьте https://2kn.to .

Здесь собраны только актуальные KRAKEN ссылки.

Если один адрес KRAKEN не работает, попробуйте https://2kn.to

кракен безопасный вход

Коротко о том, как попасть на зеркало KRAKEN :

— Откройте браузер.

— Введите https://2kn.to

— Если KRAKEN не открывается, возьмите резервный адрес из списка: приложение кракен.

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Ищете актуальные адреса для входа на KRAKEN

Проверьте https://2kn.to .

Здесь собраны только актуальные KRAKEN ссылки.

кракен сайт ссылка настоящая актуальный список на 2025.

Инструкции и помощь доступны по https://2kn.to

Ищете проверенные адреса для входа на KRAKEN

Откройте kraken зеркала рабочие — это проверенный KRAKEN адрес.

Здесь собраны только актуальные KRAKEN ссылки.

кракен зеркало актуальный список на 2025.

площадка кракен

Проблема с доступом на сайт KRAKEN?

кракен сайт даркнет

Если и это не помогло зайти на KRAKEN, проверьте FAQ: https://krakr.cc

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Ищете проверенные адреса для входа на KRAKEN

Откройте кракен сайт — это проверенный KRAKEN адрес.

Здесь собраны только актуальные KRAKEN ссылки.

https://2kn.to актуальный список на 2025.

кракен тор

Ищете актуальные адреса для входа на KRAKEN

Откройте официальный кракен — это проверенный KRAKEN адрес.

Здесь собраны только актуальные KRAKEN ссылки.

Если один адрес KRAKEN не работает, попробуйте https://2kn.to

kraken зеркала рабочие

Проблема с доступом на сайт KRAKEN?

кракен вход

вход кракен без блокировок

Хотите попасть на страницу проекта KRAKEN быстро?

вход в магазин кракен

Мы обновляем адреса по мере необходимости.

Подсказки и инструкции — по https://krakr.cc

Проблема с доступом на сайт KRAKEN?

Очищайте кэш и пробуйте резервную ссылку KRAKEN: https://krakr.cc

кракен вход магазин

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Коротко о том, как попасть на страницуKRAKEN :

— Откройте браузер.

— Введите https://kramarket.cc.

— Если KRAKEN не открывается, возьмите резервный адрес из списка: кракен даркнет сайт.

Нужен быстрый доступ к сервису KRAKEN?

Открывайте https://kramarket.cc или сайт кракен даркнет.

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес KRAKEN в закладки и пользуйтесь спокойно.

Хотите попасть на страницу проекта KRAKEN быстро?

кракен даркнет вход

Мы обновляем адреса по мере необходимости.

krakr

Нужен быстрый доступ к сервису KRAKEN?

Открывайте https://kramarket.cc или актуальная ссылка кракен.

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес KRAKEN в закладки и пользуйтесь спокойно.

Нужен быстрый доступ к сервису KRAKEN?

Открывайте https://kramarket.cc или кракен ссылка рабочего зеркала.

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес KRAKEN в закладки и пользуйтесь спокойно.

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

Коротко и по делу:

Самый прямой адрес KRAKEN — https://kramarket.cc

Резервные ссылки KRAKEN обновляются ежедневно.

Добавьте страницу KRAKEN в закладки.

рабочее зеркало сайта кракен.

Коротко о том, как попасть на страницуKRAKEN :

— Откройте браузер.

— Введите https://kramarket.cc.

— Если KRAKEN не открывается, возьмите резервный адрес из списка: kraken вход.

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Хотите попасть на страницу проекта KRAKEN быстро?

сайт кракен даркнет

Мы обновляем адреса по мере необходимости.

Подсказки и инструкции — по https://krakr.cc

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Нужен быстрый доступ к сервису KRAKEN?

Открывайте https://kramarket.cc или зеркало кракен сегодня.

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес KRAKEN в закладки и пользуйтесь спокойно.

Коротко и по делу:

Самый прямой адрес KRAKEN — https://kramarket.cc

Резервные ссылки KRAKEN обновляются ежедневно.

Добавьте страницу KRAKEN в закладки.

кракен сайт тор.

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

Коротко о том, как попасть на страницуKRAKEN :

— Откройте браузер.

— Введите https://kramarket.cc.

— Если KRAKEN не открывается, возьмите резервный адрес из списка: сайт кракен тор.

Хотите попасть на страницу проекта KRAKEN быстро?

Если нужен мобильный вход, ищите мобильную ссылку: https://krakr.cc

Мы обновляем адреса по мере необходимости.

krakr

Коротко и по делу:

Самый прямой адрес KRAKEN — https://kramarket.cc

Резервные ссылки KRAKEN обновляются ежедневно.

Добавьте страницу KRAKEN в закладки.

Перед входом KRAKEN проверьте последний апдейт по https://kramarket.cc]

Хотите попасть на страницу проекта KRAKEN быстро?

kraken cc

Мы обновляем адреса по мере необходимости.

Подсказки и инструкции — по https://krakr.cc

Коротко и по делу:

Самый прямой адрес KRAKEN — https://kramarket.cc

Резервные ссылки KRAKEN обновляются ежедневно.

Добавьте страницу KRAKEN в закладки.

кракен зеркало.

Хотите попасть на страницу проекта KRAKEN быстро?

Если нужен мобильный вход, ищите мобильную ссылку: https://krakr.cc

Мы обновляем адреса по мере необходимости.

Подсказки и инструкции — по https://krakr.cc

Хотите попасть на страницу проекта KRAKEN быстро?

Если нужен мобильный вход, ищите мобильную ссылку: https://krakr.cc

Мы обновляем адреса по мере необходимости.

кракен зеркала

Коротко о том, как попасть на страницуKRAKEN :

— Откройте браузер.

— Введите https://kramarket.cc.

— Если KRAKEN не открывается, возьмите резервный адрес из списка: kraken onion link.

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Коротко о том, как попасть на страницуKRAKEN :

— Откройте браузер.

— Введите https://kramarket.cc.

— Если KRAKEN не открывается, возьмите резервный адрес из списка: кракен сайт тор.

Нужен быстрый доступ к сервису KRAKEN?

Открывайте https://kramarket.cc или кракен вход мобильный.

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес KRAKEN в закладки и пользуйтесь спокойно.

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

Нужен быстрый доступ к сервису KRAKEN?

Открывайте https://kramarket.cc или ссылка на тор-версию кракен.

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес KRAKEN в закладки и пользуйтесь спокойно.

Нужен быстрый доступ к сервису KRAKEN?

Открывайте https://kramarket.cc или вход в личный кабинет кракен.

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес KRAKEN в закладки и пользуйтесь спокойно.

Коротко и по делу:

кракен сайт телеграм.

Резервные ссылки KRAKEN обновляются ежедневно.

Добавьте страницу KRAKEN в закладки.

кракен вход зеркало.

Коротко о том, как попасть на страницуKRAKEN :

— Откройте браузер.

— Введите https://kramarket.cc.

— Если KRAKEN не открывается, возьмите резервный адрес из списка: кракен ссылка рабочего зеркала.

Проблема с доступом на сайт KRAKEN?

кракен зеркало

kraken onion link

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

The game plays in cycles of ten free spins, with each featuring Apollo, Aphrodite, Poseidon, or hades in all their glory. The featured god unleashes his her powers at the end of the cycle, after which he she gives way to another god chosen randomly from the list. The game plays in cycles of ten free spins, with each featuring Apollo, Aphrodite, Poseidon, or hades in all their glory. The featured god unleashes his her powers at the end of the cycle, after which he she gives way to another god chosen randomly from the list. With the lightning bolt Collect symbol in his hand, Zeus watches over Olympus and oversees your attempts at striking it rich. Will you be satisfied with the payouts on the ever-changing main reels, or will only Free Spins with multiplier Wilds and Coin Respin with 3 Jackpots satiate your thirst for big wins?

https://jasperres.com/top-online-casinos-offering-tower-x-game-best-choices-for-indians/

Have you ever wondered what it’s like to spin the reels in the realm of ancient gods? Buckle up, because KA Gaming’s Olympus Gods slot is about to take you on a wild ride through Mount Olympus itself. Whether you’re a seasoned spinner or just looking for some divine entertainment, this game’s got something for everyone. Get notified about our video interviews, slot reviews and other exciting video content. All our videos are published on YouTube first. Do you want a chance to win colossal amounts of cash? If so, play Ancient Gods slots with progressive jackpots like Eye of Horus: Jackpot King. Nine symbols make up the paytable. They are playing card faces from A-J, flowers, Ankh, Horus, Anubis, and the Eye of Horus. The scatter is an old tomb, while the wild is an Egyptian god.

Хотите попасть на страницу проекта KRAKEN быстро?

Если нужен мобильный вход, ищите мобильную ссылку: https://krakr.cc

Мы обновляем адреса по мере необходимости.

зеркало кракен сегодня

Коротко и по делу:

Самый прямой адрес KRAKEN — https://kramarket.cc

Резервные ссылки KRAKEN обновляются ежедневно.

Добавьте страницу KRAKEN в закладки.

Перед входом KRAKEN проверьте последний апдейт по https://kramarket.cc]

Ищете проверенные KRAKEN зеркала?

кракен зеркало.

Список обновляется, так что проверяйте время последней проверки.

Подробная инструкция по подключению к KRAKEN — здесь: https://kramarket.cc

Нужен быстрый доступ к сервису KRAKEN?

Открывайте https://kramarket.cc или кракен вход.

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес KRAKEN в закладки и пользуйтесь спокойно.

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

Ищете проверенные KRAKEN зеркала?

кракен вход на сайт.

Список обновляется, так что проверяйте время последней проверки.

Подробная инструкция по подключению к KRAKEN — здесь: https://kramarket.cc

Нужен быстрый доступ к сервису KRAKEN?

Открывайте https://kramarket.cc или кракен вход на сайт.

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес KRAKEN в закладки и пользуйтесь спокойно.

Хотите попасть на страницу проекта KRAKEN быстро?

Если нужен мобильный вход, ищите мобильную ссылку: https://krakr.cc

Мы обновляем адреса по мере необходимости.

Подсказки и инструкции — по https://krakr.cc

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

Ищете проверенные KRAKEN зеркала?

зеркало кракен сегодня.

Список обновляется, так что проверяйте время последней проверки.

Подробная инструкция по подключению к KRAKEN — здесь: https://kramarket.cc

Проблема с доступом на сайт KRAKEN?

Очищайте кэш и пробуйте резервную ссылку KRAKEN: https://krakr.cc

Если и это не помогло зайти на KRAKEN, проверьте FAQ: https://krakr.cc

Хотите попасть на страницу проекта KRAKEN быстро?

Если нужен мобильный вход, ищите мобильную ссылку: https://krakr.cc

Мы обновляем адреса по мере необходимости.

кракен зеркало

Проблема с доступом на сайт KRAKEN?

Очищайте кэш и пробуйте резервную ссылку KRAKEN: https://krakr.cc

Если и это не помогло зайти на KRAKEN, проверьте FAQ: https://krakr.cc

Коротко о том, как попасть на страницуKRAKEN :

— Откройте браузер.

— Введите https://kramarket.cc.

— Если KRAKEN не открывается, возьмите резервный адрес из списка: кракен сайт вход.

keyword.

Сохраняйте рабочие адреса KRAKEN и проверяйте их перед входом.

Хотите попасть на страницу проекта KRAKEN быстро?

кракен даркнет вход

Мы обновляем адреса по мере необходимости.

актуальная ссылка кракен

Нужен быстрый доступ к сервису KRAKEN?

Открывайте https://kramarket.cc или kraken.

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес KRAKEN в закладки и пользуйтесь спокойно.

Проблема с доступом на сайт KRAKEN?

Очищайте кэш и пробуйте резервную ссылку KRAKEN: https://krakr.cc

Если и это не помогло зайти на KRAKEN, проверьте FAQ: https://krakr.cc

Нужен быстрый доступ к сервису KRAKEN?

Открывайте https://kramarket.cc или кракен ссылка рабочего зеркала.

Мы следим за ссылками KRAKEN и обновляем их регулярно.

Скопируйте адрес KRAKEN в закладки и пользуйтесь спокойно.

Проблема с доступом на сайт KRAKEN?

Очищайте кэш и пробуйте резервную ссылку KRAKEN: https://krakr.cc

Если и это не помогло зайти на KRAKEN, проверьте FAQ: https://krakr.cc

Хотите попасть на страницу проекта KRAKEN быстро?

кракен сайт вход

Мы обновляем адреса по мере необходимости.

кракен вход магазин

Ищете альтернативу KRAKEN?

Вот ещё вариант: https://krakr.cc

взгляните на сайте здесь

водка бет

KRAKEN ссылка TOR помогает подключиться к кракен онион даже при ограничениях.

KRAKEN ссылка TOR помогает подключиться к кракен магазин даже при ограничениях.

KRAKEN вход в личный кабинет всегда доступен. Рабочее зеркало кракен онион помогает пройти авторизацию.

KRAKEN кракен маркетплейсдаёт быстрый доступ без перебоев. Рабочее зеркало открывает все разделы площадки, а вход в личный кабинет доступен даже новичкам.

Актуальный вход KRAKEN доступен тут:

kraken зекрало

Если старые домены не грузятся, пользуйтесь зеркалом: https://anicore.ru/threads/1/.

Не требует VPN.

Проверено лично.

У многих не открывается сайт KRAKEN?

Вот рабочая ссылка, только что проверил:

kraken зайти

Если снова будет блокировка — вот резерв: https://anicore.ru/threads/1/.

Удобно, быстро, без ограничений.

веб-сайт CS BOX

K.N. proudly joins our list of Casino Rewards multimillionaires after hitting a shocking $5,748,072.67 win on Immortal Romance Mega Moolah at Grand Mondial Casino on September 24th, 2022! Basic Game Info If you’re a fan of high-volatility slots and epic bonus rounds, then Gates of Olympus (1000) is the game for you. At several reliable online casinos listed in the table below, you can claim free spins on Gates of Olympus without making a deposit. Simply register a free account and the spins will be added, no need to risk your own money. Access Gates of Olympus bonus options at leading New Zealand sites, where you can receive a welcome bonus with free spins or cash rewards upon registration to explore this slot. Our selected venues deliver reliable service and quick withdrawals for a smooth session.

https://computer.busswe.info/astronaut-slot-pakistani-version-whats-new/

Of course, the collection of slots and the list of casino games that is always growing will interest anyone in the UK who likes to play slots online. If you can’t wait for the scatter symbols to land and win you free spins naturally, you can trigger them with the buy bonus. The buy bonus feature lets you enter the free spins round from the base game anytime. This game is closely linked to Pragmatic Play’s Sweet Bonanza as the two games have similar gameplay. Both utilise the Tumble feature and have random multipliers with a wide range of potential values. Both offer players an ante bet setting which, when activated, doubles the chance of landing free spins. You’ll find plenty of streamers and player forums comparing the two games and trying to figure out which one is best! The game has a max win of 5,000x and is a high volatility game. More on this later.

пояснения FreeCS

Узнать больше CSGO

Узнать больше https://kra48a.at/